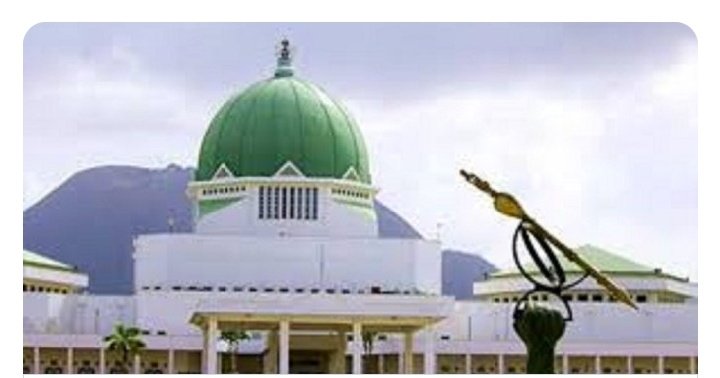

The National Assembly is reportedly discussing a bill to raise the value-added tax (VAT) from 7.5% to 10% by 2025. According to TheCable, the bill proposes a gradual increase, with VAT set to reach 12.5% by 2026 and 15% by 2030.

VAT, a consumption tax levied on goods and services at each stage of production and distribution, is currently set at 7.5% following a revision in 2020. The proposed changes outlined in the executive bill indicate a structured approach to VAT increases over the next decade, to progressively raise the tax to 15% by 2030. The bill reportedly reads: “VAT shall be charged on the value of all taxable supplies at the following rates: (a) 2025 year of assessment – 10%; (b) 2026–2029 years of assessment – 12.5%; and (c) 2030 year of assessment and thereafter – 15%.”

This proposal follows a recommendation made earlier this year by Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, who advocated for an increase in VAT to boost government revenue. International organizations like the International Monetary Fund (IMF) have also previously advised Nigeria to raise its VAT rate, suggesting a 10% target by 2022.

The proposed hike has sparked mixed reactions. While some view it as a necessary measure to improve Nigeria’s fiscal health, others see it as burdensome for the average citizen. Former Vice President Atiku Abubakar was quick to criticize the plan, labeling it a “regressive and punitive policy” that would negatively affect ordinary Nigerians. Conversely, Wale Edun, the Minister of Finance, has stated that while VAT rates are under review, no immediate changes have been implemented yet.

If passed, this bill would mark a significant shift in Nigeria’s tax policy, with VAT gradually increasing over the next few years, potentially impacting both businesses and consumers across the country.